ENABLE CONVENIENT CUSTOMER SELF-SERVICE

Many banks equate digital transformations with new mobile apps. While crucial, neglecting the integration of bank employee channels and processes can lead to inconsistent customer support, varying process execution across channels, and diminished employee satisfaction, all undermining digital goals.

Axxiome Digital excels in integrating Customer Channels with banking processes, guaranteeing consistent execution and an improved customer journey. Our method eliminates redundant steps, streamlines operations, and refines the banking experience for customers and employees alike.

Key Features

The Axxiome Digital Web and Mobile Application is thoughtfully crafted to tailor itself to the bank's specific user experience preferences and aesthetic appeal. It works seamlessly integrated with bank processes and employee channels, offering customers a truly unified Omnichannel experience.

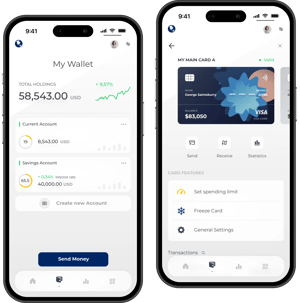

RETAIL MOBILE BANKING

Axxiome Digital's Mobile App empowers customers to perform all essential banking activities seamlessly:

- Move Money between accounts

- Transfer money to friends, family and businesses

- Manage accounts and cards

- Scan and deposit cheques

- Split bills

- Chat with a representative

- Find an ATM

- and more...

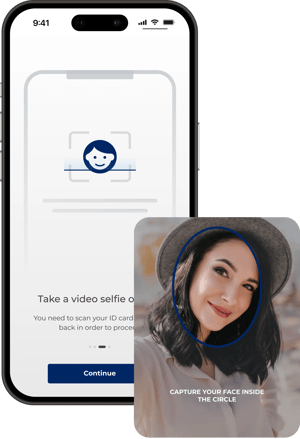

REMOTE ONBOARDING

The successful onboarding of new customers plays a vital role in a bank's success. Axxiome Digital empowers bank customers to complete the entire procedure remotely within minutes, by incorporating:

- ID Scanning

- Remote Customer Identification

- Digital Signature

- Real-time Account Origination

- Digital Wallets Integration

- Funding Options

Read more about our Digital Onboarding solution.

RETAIL WEB APPLICATION

Axxiome Digital's Web Experience offers the same capabilities as the mobile application, and encompasses additional functionality on top:

- Advanced Data Export

- Financial Analytics

- Extended Reporting

- and more...

OTHER CAPABILITIES

Benefits

- Customer Retention: Improved user experience can enhance loyalty.

- Cross-selling Opportunities: Insights into customer behavior can highlight opportunities for additional product sales.

- Reduced Costs: Digital interactions can be more cost-effective than physical ones.

- Convenience: 24/7 access to banking services from any location.

- Real-time Information: Instant updates on transactions, balances, and other account details.

- Faster Service: Reduced waiting times for services like loan approvals, fund transfers, etc.

- Operational Efficiency: Automation and streamlined processes reduce overheads and manual errors.

- Secure Investments: Seamlessly integrates with any existing third-party solutions.

FREQUENTLY ASKED QUESTIONS

Certainly! Axxiome offers Axxiome Digital as a platform, allowing banks to utilize its APIs and access all the business capabilities seamlessly, without the need to modify the existing Retail Banking Applications.

RELATED RESOURCES