UNLOCK THE FUTURE: ONBOARDING REDEFINED

Embrace the next era of banking with our groundbreaking Digital Customer Onboarding platform. Eliminate the drudgery of paperwork and extended wait times.

We've designed this platform to grant banks the ability to offer an uninterrupted, safe onboarding journey for clients, all from the sanctuary of their personal spaces. Dive into simplicity, speed, and security as we redefine what it means to join a bank in this digital age.

Key Features

Complete the customer onboarding process in a mere 5 minutes. Bolstered by genuine omnichannel capabilities, customer service representatives are empowered to efficiently navigate customers through their onboarding journey. Additionally, the platform seamlessly integrates with our robust Account Origination solution, creating a unified and streamlined experience.

SEAMLESS MOBILE ONBOARDING

Allow customers to securely onboard, open accounts and access banking services without ever stepping foot inside a branch.

- Digital identity verification

- Flexible Retail and Commercial customer input forms

- Rule-based documents submission

- Rule-based bank auto-approvals

.webp?width=300&name=Effortless%20Remote%20Onboarding%20-%20Device%20-%201%20(2).webp)

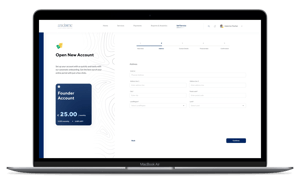

EMBEDDED IN YOUR WEB PRESENCE

Our web-based onboarding platform enables customers to seamlessly onboard right from your website, initiate account openings, and tap into banking services without the need for branch visits. The whole onboarding process is handled digitally. This ensures a frictionless and user-friendly customer experience, while meeting rigorous security standards.

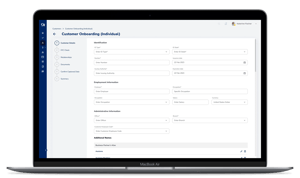

IN-BRANCH ONBOARDING

Our in-branch onboarding process is designed for those who value face-to-face interactions without sacrificing digital efficiency. Guided by your teller agents, customers can initiate onboarding and account openings, all facilitated digitally. From document presentation to capturing digital signatures, the entire process combines traditional banking with modern digital tools, providing an optimal, secure, and efficient experience right within the branch.

ONBOARDING ASSISTANCE

Seamlessly blend online and offline interactions by integrating our platform with your service center. Our solution ensures a consistent customer journey, whether they're starting the process online or seeking personalized assistance over the phone or face-to-face. It's the perfect blend of convenience and human touch, enhancing customer satisfaction and loyalty.

OTHER CAPABILITIES

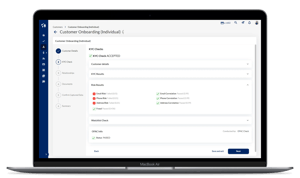

Facilitate compliance management and reduce risk by embedding your policies and controls into the onboarding process.

Rule-based application approval workflow, supporting automatic approvals as well as four-eyes-principle decision making.

Real-time customer updates, ensuring transparency and enhancing user engagement for a seamless onboarding experience.

Benefits

- Enhanced Market Reach: Expands customer accessibility beyond geographic constraints, attracting a broader audience.

- Convenience: Allows customers to register or initiate services anytime, anywhere, without physical constraints.

- Speed: Reduces the time taken to onboard, compared to traditional methods.

- Reduced Costs: Diminishes overheads associated with paper, manual labor, and physical space.

- Accuracy: Minimizes human error, ensuring precise data collection and processing.

- Eco-friendly: Reduces the need for paper, thereby being more sustainable.

- Real-time Verification: Instantly verifies documents and customer details, enhancing trust.

- Adaptability: Can be updated quickly to comply with changing regulations or customer needs.

FREQUENTLY ASKED QUESTIONS

RELATED RESOURCES